1-877-475-2010

Call Joe in Florida

25400 U.S. 19 N, Suite 221

Clearwater, FL 33763

25400 U.S. 19 N, Suite 221

Clearwater, FL 33763

1-877-475-2010

1-877-512-9287

The game Six Degrees of Kevin Bacon teaches us that we are all connected, sometimes in unexpected ways.

The game Six Degrees of Kevin Bacon teaches us that we are all connected, sometimes in unexpected ways.

Some members of the NAIC's LTC Innovation Subgroup want to go beyond the stand-alone LTCI silo.

Some members of the NAIC's LTC Innovation Subgroup want to go beyond the stand-alone LTCI silo.

But often advisors were found to “give one member of the couple more status: the male,” the survey found.

But often advisors were found to “give one member of the couple more status: the male,” the survey found.

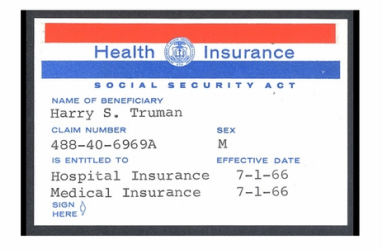

Before 2013, Medicare paid for SNF care only if a patient was still getting better.

Before 2013, Medicare paid for SNF care only if a patient was still getting better.

These are the new opportunities for advisors and agents selling whole life policies.

These are the new opportunities for advisors and agents selling whole life policies.

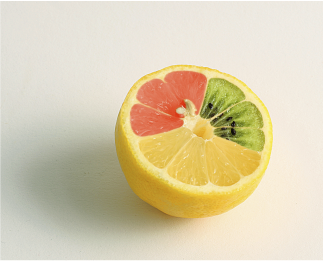

How diversified are your clients with their life insurance coverage?

How diversified are your clients with their life insurance coverage?

With 28.2 million small businesses in America, and with four of every 10 grappling with a transfer of ownership issue, the market seems primed for business succession planning outreach.

With 28.2 million small businesses in America, and with four of every 10 grappling with a transfer of ownership issue, the market seems primed for business succession planning outreach.

Offering disability income insurance is an excellent way to satisfy a very real client concern.

Offering disability income insurance is an excellent way to satisfy a very real client concern.

|

You can’t live without water for more than a few days. It doesn’t matter if you’ve had the best survival training, after a few days without water your body just stops working.

Water isn’t something that is nice to have. It’s something you need in order to stay alive. The same can be said of food and oxygen and sunlight. Without those things you will not survive. They aren’t luxuries; they are absolute essentials. To achieve the outrageous success you crave, you need to be the water, food, oxygen and sunlight others need in their lives right now. You need to be so valuable to them they just can’t make it without you. Read more... |

|

Having a spouse correlates with a huge reduction in the risk that consumer will enter a nursing home.

In the past, while thinking about topics for blog entries, I've thought about the concept of "risk reduction marketing" -- efforts to reach out to prospects and clients with ideas and swag that may actually help keep people comfortable and safe. Long-term care insurance (LTCI) marketers could consider emphasizing what great, helpful, insightful people they are by using small, inexpensive flashlights as novelty giveaways. The recipients might use the flashlights to look inside their noses and cabinets on ordinary days -- and to stay safe during blackouts. LTCI marketers could protect clients against the risk of macular degeneration and other vision problems that can be caused or aggravated by exposure to sunlight by simply encouraging the people they meet to invest in good sunglasses. Read more... |

|

These middle-aged prospects are ready for guidance and products that offer more safety. Are you ready for them?

Baby Boomers have been big business for insurance professionals. But the spotlight is moving its way across the stage to shine on Generation X. They are ready for guidance, specifically on products that offer more safety. This wave of younger financial consumers (roughly defined as those between 34 and 49 years old) come with little confidence about investing after walking through the dot-com boom and recent recession. They yearn for financial security. Fixed annuities become a natural solution to meet many of their financial planning needs. Studies conducted since the 2008 crash reveal everyone is a bit more conservative. Even more, Gen Xers in their 40s said they want even greater certainty about retirement income than Baby Boomers did. Read more... |

|

A financial adviser explains that when you hear only what you want to hear, you can end up making some bad money choices.

Allison sat in my office, singing the praises of an annuity she had recently purchased. She was 64 years old, and she had come in for a free initial consultation after listening to my radio show. “The investment guy at the bank,” she crowed, “told me this annuity would pay me a guaranteed income of 7% when I turn 70.” I asked her to tell me more. Read more... |

|

Insurance agents and financial advisors in the disability space would do themselves a favor if they held off on the pie charts, the statistics and the tables, according to Carol A. Harnett, the new president of the Council for Disability Awareness (CDA).

Instead, advisors should approach prospects through storytelling to connect emotionally with prospects because it’s more effective, said Harnett. “Start telling stories from the audience perspective and you start to gain their attention,” said Harnett, in an interview with InsuranceNewsNet. Read more... |

|

How should you respond when prospects ask you to tell them about your stuff? Most salespeople would get excited by this question, because they would think their prospects were interested in what they have to offer. But the truth is your prospects are really looking for a way to dismiss you. So beware: If you attempt to talk about your stuff at this stage, you’re doomed.

So what should you do? Rather than trying to give a quick overview of your offering, tell them a story. Be prepared to share a real-live customer scenario which you know will appeal to them. Read more... |

|

Sometimes one of the greatest ways to provide great customer service is to give something of value away for free. It doesn’t have to be anything big or expensive. It can be something small—even really small. It just has to be valuable to the customer.

Think about the owner of a restaurant who buys his regular customers a drink or a dessert. Actually, that’s not small enough. I’m talking really small—something that costs your only a dollar or two. Read more... |

|

Postema Marketing Group is a full-service Independent Marketing Organization (IMO) dedicated to providing world-class products and services to our clients. We have partnered with some of the strongest names in the insurance industry and proudly serve independent agents from coast to coast.

|

GET IN TOUCH.

Check us out on Social Media! Remember to Like, Follow, and Connect with us so you never miss out on the Latest Blog Posting's, Webinars, Updates, and Much More!

|

QUICK LINKS.Home

|